House budget plan is a dangerous starting point for the North Carolina budget debate

Today the North Carolina House of Representatives passed its proposed two-year plan for the state budget following the plan’s release last week. This follows the Governor’s budget recommendations released in March and the updated revenue forecast, compiled by the state’s economists, released in February.

Not only is this budget “not perfect,” as one House budget writer puts it, it actively commits harm both through its additions and omissions and fails to seize the opportunity our leaders have to use public resources to advance the public good.

Now the attention will turn to the Senate, which will propose their budget and then come to agreement on a version with the House. While the goal is typically for the chambers to come to agreement on a state budget prior to the July 1 start of the new fiscal year, recent history has demonstrated that the General Assembly leaders are willing to defy that deadline.

Instead of taking bold steps to advance priorities like schools and economic security (as one budget writer claims this budget does), this budget undercuts public schools in favor of private schools and overlooks common-sense tax credits for working families in favor of a narrow tax credit for adoption and an untargeted increase in the child deduction.

Current House leaders, who drive much if not all of the policy and appropriations decisions reflected in what ultimately gets enacted, have once again decided to advance the interests of private corporations and wealthy North Carolinians ahead of the needs felt across the state.

The budget fails to roll back the elimination of the corporate income tax and accelerates the cuts to the already flat personal income tax, both of which will be catastrophic to public services and institutions for decades to come, and which advance the interests of the wealthy few at the expense of ordinary North Carolinians. The budget also demonstrates a brazen disregard for the state’s constitution and responsibility to serve all North Carolinians by failing to adequately invest in what’s needed to provide a sound, basic education for every child in the state.

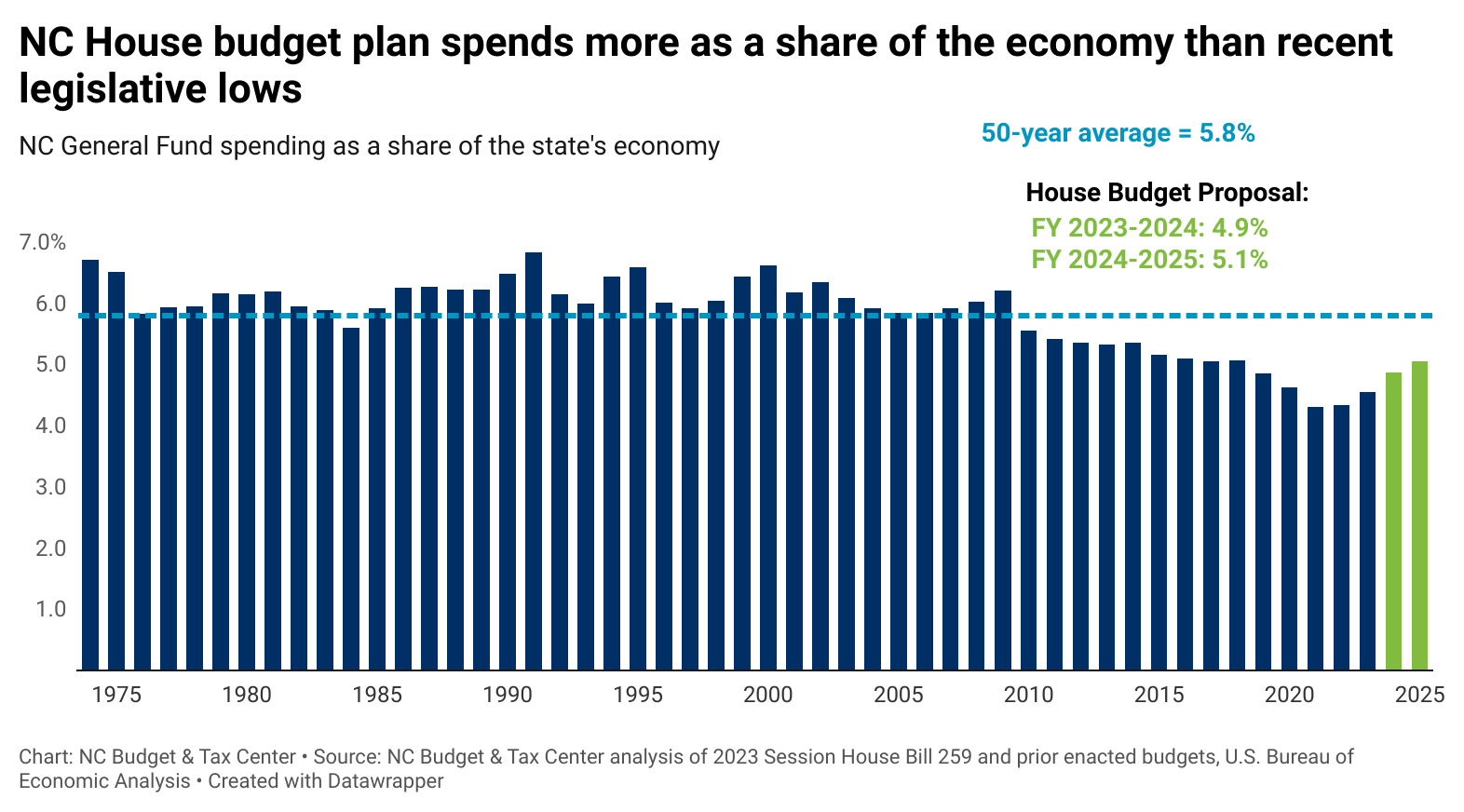

Spends more as a share of the economy than the recent legislative lows

The House budget proposes spending at levels higher than in recent years relative to the size of the state’s economy, as measured by total state personal income. However, recent history represents an anomaly for the past 50 years with respect to spending compared to the state’s economy.

The House budget would increase spending to $29.8 billion in Fiscal Year (FY) 2023-2024, the first year of the biennium that begins this July. Compared to the 50-year average of 5.8 percent spending as a share of the economy (represented by the blue dashed line in the figure), the proposal would spend 4.9 percent in the first year, or $5.6 billion below the 50-year average

For FY 2024-2025, the proposal would spend $30.9 billion, representing 5.1 percent compared to the economy, which is $4.2 billion below the 50-year average. However, the second-year spending proposal (2024-2025) will be subject to changes next year during the “short” legislative session.

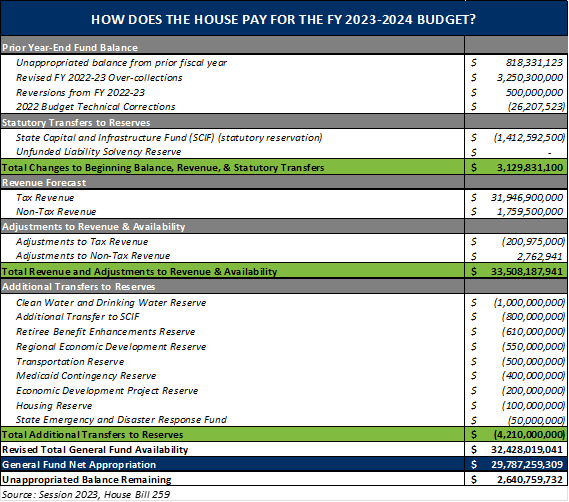

Reserves funds for spending through convoluted and untransparent processes

With the harmful effect of sidelining critical public resources, as has been championed in the legislature as of late, this budget proposal transfers over $4 billion in a handful of reserve accounts above and beyond the statutory requirements that have been set in place in recent years. For example, while the statutory requirement for the State Capital and Infrastructure Fund is $1.4 billion in the first year, the budget proposes an additional $800 million transfer, bringing the total to over $2.2 billion for the first year of the budget.

With these fund transfers occurring at the outset of the budget documents, the funding is simultaneously not included in the spending totals but also not appropriated to specific items in a way that is transparent to the public in any way.

In addition, the budget’s availability summary reveals that the available revenue minus spending and reserve transfers leaves approximately $2.6 billion left unappropriated in the first year of the budget. This large amount goes beyond the scale of what’s needed for prudent budget practices, particularly for a budget that continues North Carolina on a path to the elimination of income taxes.

Accelerates the path to zero income taxes

The House proposes maintaining the legislative plan enacted in 2021 to eliminate the corporate income tax by the end of this decade, which will eliminate an estimated $900 million in state revenue each year when the rate reaches zero. The failure to pull back this harmful tax cut, which exclusively affects the profits that businesses make, will negatively affect the well-being of every community in North Carolina.

In addition, the House budget proposes a change to the legislature’s 2021 tax cuts by accelerating the path to the legislature’s ultimate goal of zero income taxes. The proposed change would lower the 2024 personal income tax rate to 4.5 percent from the current rate of 4.75 percent, whereas current law would lower the rate to 4.6 percent in 2024 and 4.5 percent in 2025, with further declines thereafter reaching 3.99 percent in 2027. The personal income tax rate reduction will reduce state revenue by $2.6 billion each year when fully implemented in 2027. Such revenue loss will prevent the state from generating enough funding to provide critical public services — from public schools to roads and bridges to public health programs — that help keep our communities healthy.

Sticking with the tax cut plan and doubling down on it is particularly concerning given projections that revenue will be lower in future fiscal years due to a slowing economy. Revenue available for the upcoming fiscal year remains uncertain until after the April income tax filing deadlines, after which an updated revenue forecast will be released by the state’s economists.

Subverts democracy and bypasses transparency altogether

While state budgets in recent history have contained their fair share of policy changes that have little to no funding implications, this budget includes an inordinate number of policy changes that had no opportunity for discussion in substantive committee meetings.

Arguably the most concerning aspect of the process by which the House took to pass their budget is the continuation of what over several years has been a breakneck pace from public introduction to passage. This unreasonably rapid process includes the following:

- The unreasonably short amount of time between when the bill is introduced to the time it’s first voted on in committee;

- The nonexistent or limited opportunities for public input into the process or the substantive issue areas, including a lack of consideration or any public assessment of needs across the state;

- The bypassing of substantive committee discussions and debates, particularly given the number of substantive policies included in the budget bill in addition to the funding decisions;

- The quick turnaround times for amendment deadlines as well as the restrictive procedural rules, set by the leadership of the majority party, that greatly limit the nature of the amendments possible.

These rules for how the body will operate are set by House Speaker Tim Moore and Rep. Destin Hall (as Rules Committee Chair), and are maintained by the chairs of the Rules Committee.

These expedited steps in the important state budget process come at a cost for the state’s democracy and, as a result, at the cost for the people of North Carolina. With each step of the process, North Carolinians themselves are left out of the process, as well as many lawmakers that the people elected to represent them in the General Assembly. A state budget crafted without the voice of the people and their elected representatives is not a budget that advances the priorities of the people of North Carolina.

As the process now turns to the Senate, the Budget & Tax Center hopes for a better budget that invests in people with a process that both takes stock of the needs across the state as well as the resources we collectively have to invest to ensure that everyone in North Carolina can thrive — not just the wealthy few.